In order to survive the Coronavirus crisis, many small businesses and their owners take actions such as delaying tax payments due to extensions, cutting unnecessary expenses, asking for extra time from vendors for payables, borrowing money from financial institutions, looking for state non-refundable grants, laying off their employees, and similar measures that would hurt their business and their employees.

However, one of the most important economic tools during this outbreak for small businesses and nonprofits is the Economic Injury Disaster Loan Program (EIDL) from the Small Business Administration (SBA).

Small business owners within all 50 U.S. states and territories (or U.S. Territory Disasters in American Samoa, Guam, or The Commonwealth of Northern Mariana Islands) are currently eligible to apply for the Economic Injury Disaster Loan Program due to Coronavirus (COVID-19).

Who is a Small Business?

The SBA has size standards to determine if a business qualifies as a “Small Business”. The size standards are for the most part expressed in either millions of dollars in sales (revenue) or the number of employees a business has. For example; a residential remodeling company with $39.5 million revenue or a manufacturing company, with any amount of revenue, employing 1,500 people or less, can qualify for a Small Business definition for the SBA standards.

That is why, all of the self-employers, sole-proprietors, small business owners, small and medium enterprises (SME), start-ups that are affected by the COVID-19 outbreak should consider applying for SBA Disaster Loans.

Currently, the EIDL program is one of the best ways for small businesses to access capital for the following reasons;

Low-Interest Rate

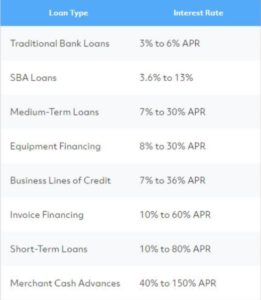

The SBA Disaster Assistance program offers loan at 3.75 percent for small businesses and 2.75 percent for nonprofits. Although some business owners argue that this is still a loan rather than assistance, the rate is much lower than traditional SBA loans and commercial loans most businesses can get.

The interest rate (APR) on the market for business funding usually starts from 7 percent depending on a loan type. Rates on some loans can even go up to 150 percent such as Merchant Cash Advances. Additionally, many small businesses have financed vehicles that have a rate much higher than 3.75 percent.

Easy Process

Getting a traditional SBA loan requires a long time and process; sometimes over a year. In addition, struggling businesses aren’t always eligible for that loan. However, SBA currently offers Coronavirus Disaster Loan for small businesses and nonprofits to recover from declared disasters with a 3-step process.

Step 1: Apply for a loan online; in-person at a disaster center; or by mail.

Step 2: SBA reviews your application, checks your credit, conducts inspections to verify your loss and determine your eligibility.

Step 3: SBA will prepare and send you Closing Documents for the loan to you for signature and makes initial disbursement within five business days.

Long-Term Loans

SBA offers the Coronavirus (COVID-19) disaster loan for a longer term; up to 30 years repayment period. That allows installment payments in much smaller amounts and makes repayment more affordable.

Another advantage of having a long-term loan is that inflation makes the loan amount less valuable in the future. The annual inflation rate for the United States is 2.3 percent for the 12 months that ended February 2020.

However, SBA determines terms for repayment period case-by-case, based on each borrower’s ability to pay back the loan.

Loan Amount: Up to 2 Million

SBA’s Economic Injury Disaster Loans offer up to $2,000,000 which can be a very important economic support for a small business during the Coronovirus crisis. The SBA also has the authority to waive the limit and increase the loan amount above $2 million, if the business is a major source of employment.

The actual amount of the loan is determined by the SBA based on financial need due to the Coronavirus economic injury and the borrower’s financial condition.

Documentations and requirements

Applicants’ credit history and financial condition until the date they started to get impacted by the COVID-19 crisis affect the loan amount.

SBA credit requirement states that “Collateral is required for all EIDL loans over $25,000. SBA takes real estate as collateral when it is available. SBA will not decline a loan for lack of collateral, but SBA will require the borrower to pledge collateral that is available”.

Additionally, applying businesses have to show that they have been in operation for at least one year prior to the disaster in order to expedite the loan application process.

It is important for small business owners to submit all the required documents, demonstrate their ability to repay the loan and their financial need due to economic injury in order to get the highest possible loan amount.

It is crucial to talk to a qualified advisor regarding this application to avoid unnecessary delays and rejections.

______________________

This article is posted by and in partnership with Imposta, a tax preparation and accounting firm based in Fairfax, Virginia.